st louis county sales tax 2021

The median property tax in St. Statewide salesuse tax rates for the period beginning October 2021.

Starting A Business In St Louis Live Life Entrepreneurially

Tax Forfeited Land Sales.

. The St Louis County sales tax rate is 0. You pay tax on the sale price of the unit less any trade-in or rebate. Louis county provides the annual financial transparency.

In real dollars taxable sales and use are down 18 from 2000 levels. Zip Code in St. Free Life Chapel Daycare.

Louis County February 25 2021 Timber Auction Sales Package Tract. Browse Geographies within 63049 MO. Statewide salesuse tax rates for the period beginning July 2021.

Saint louis mo sales tax rate. 052021 - 062021 - PDF. There is no applicable county tax.

Florida Estate Tax Apportionment Statute. Top Property Taxes 63049. There is no applicable county tax.

Louis County Collector of Revenues annual tax sale on Monday August 23 2021. 042021 - 062021 -. St Louis County Sales Tax 2021.

Life At The Zoo Chester. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. St louis county sales tax 2021.

The Missouri state sales tax rate is currently 423. Cordsac Pine-Norway 33 74 236. April 19 2022 - Sale 211.

The 2018 United States Supreme Court decision in South Dakota v. Ad Download tables for tax rate by state or look up sales tax rates by individual address. May 24 2022 - Sale 212.

State Muni Services. Casey Anderson Virginia Area C19210001 Total Appraised. 072021 - 092021 - PDF.

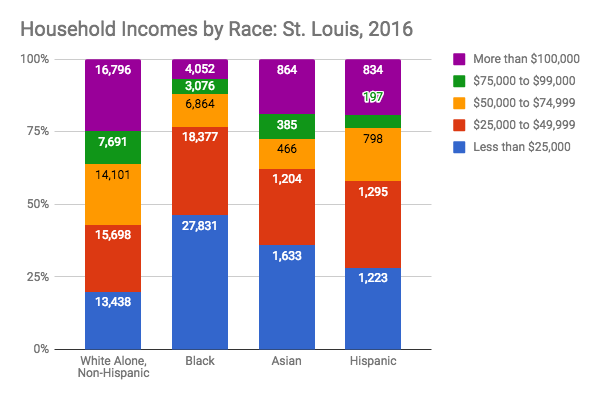

Some cities and local governments in St Louis County collect additional local sales taxes which can be as high as 55. This is the total of state and county sales tax rates. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Nassau County Tax Grievance Deadline 2022. Rate tables and calculator are available free from Avalara. The Minnesota state sales tax rate is currently 688.

Subtract these values if any from the sale. Louis County Sales Tax is collected by the merchant on all qualifying sales made. St Louis County Missouri Sales Tax Rate 2022 Up to 11988.

Tax forfeited land managed and offered for sale by St. A link to the list of properties will be posted on this page after the date of publication which is two weeks prior to the sale. 1 C21-641705 Sale Administrator.

Louis County Real Property Tax Sale On August 23 2021 Real estate properties with three or more years of delinquent taxes will be offered for auction at the St. 102021 - 122021 - PDF. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

Property owners who are behind in their taxes are encouraged to make payments throughout the year to catch up and keep their property out of the sale. 257500 Down Payment Required. Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143 counties in order of median property taxes.

The sales tax jurisdiction name is St. A list of land for potential sale is prepared by the Land Minerals Department and submitted for County Board approval. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax.

Louis County is land that has forfeited to and is now owned by the State of Minnesota for the non-payment of taxes. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund transportation districts local attractions etc. This is the total of state and county sales tax rates.

Granbury Tx Steak Restaurants. Due to the ongoing public health crisis the 2021 tax sale will be conducted via sealed bids only. Louis County collects on average 125 of a propertys assessed fair market value as property tax.

The minimum combined 2021 sales tax rate for st louis county minnesota is. Louis which may refer to. The minimum combined 2022 sales tax rate for St Louis County Minnesota is 738.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. Louis MO 63103 Sales are held outside of the building on the 11th Street side. 12102021 MOTOR VEHICLE BUREAU Motor Vehicle Sales Tax Rate Chart Updated 12102021 16250 17000 22000 TO BE USED FOR THE MONTHS OF JANUARY FEBRUARY MARCH 2022 The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is.

Statewide salesuse tax rates for the period beginning May 2021. 4 5 Total Acres. The St Louis County sales tax rate is 226.

What is the sales tax rate in St Louis County. 1209 Diamond Valley Drive. 2 Species Sticks Dia.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special rate 125. Missouri Department of Revenue Run Date.

Information reflective of 2021 Recorder Assessor Data. The 11679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax 5454 Saint Louis tax and 2 Special tax. Louis County MO.

General Median Sale Price Median Property Tax Sales Foreclosures. Sales are held at 900 am sharp at. The St Louis County Sales Tax is 2263.

Office of the SheriffCollector - Real Estate Tax Department Summary Land Tax sales are held 5 times in 2022. Civil Courts Building 10 North Tucker Blvd 4th floor St.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Missouri Tax Free Weekend 2021

Missouri Income Tax Rate And Brackets H R Block

Action Plan For Walking And Biking St Louis County Website

St Louis County Municipalities And Better Together 4 Things To Know

St Louis Remote Workers Challenge City S Earnings Tax

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

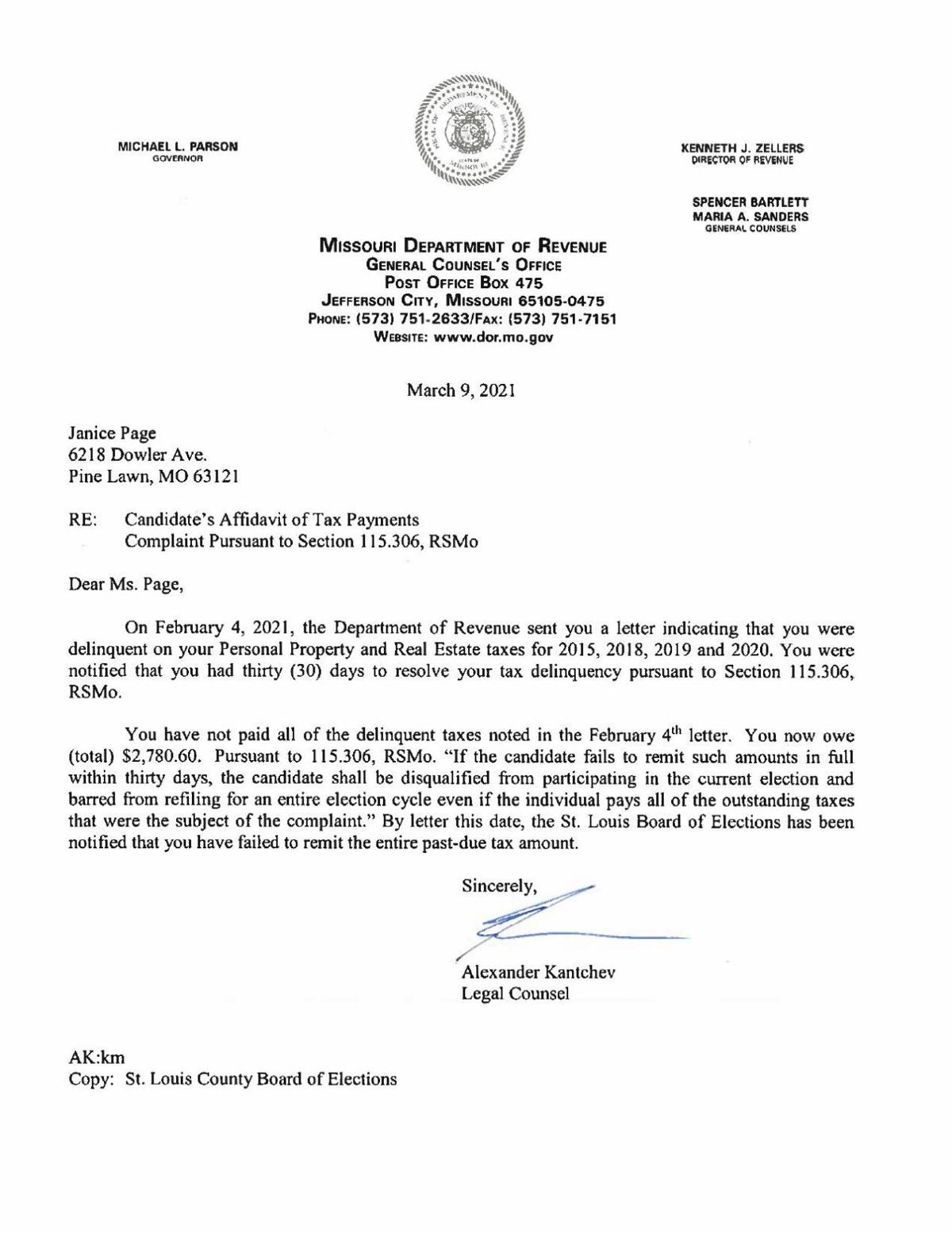

March 9 Revenue Department Letter Disqualifying Janice Page For Failing To Pay Taxes Online Stltoday Com

1054 Glenbrook Ave St Louis Mo 3 Beds 1 5 Baths In 2021 Outdoor Furniture Sets Outdoor Outdoor Decor

Solved Illinois Schedule Cr Credit For Taxes Paid To Ot

11 Best Financial Advisors In St Louis Clayton Mo 2021 2022 Ranking Advisoryhq

Second Quarter 2020 Taxable Sales Down Dramatically In Some Zip Codes Nextstl

Action Plan For Walking And Biking St Louis County Website

Collector Of Revenue St Louis County Website

County Executive St Louis County Website

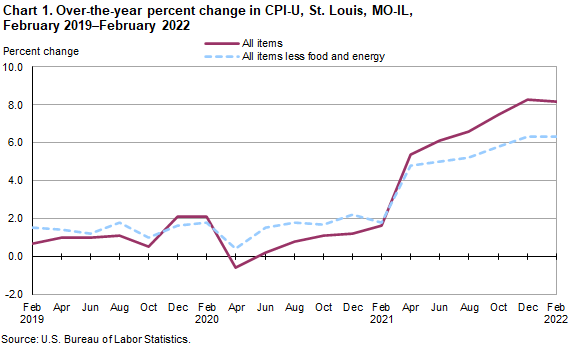

Consumer Price Index St Louis February 2022 Mountain Plains Information Office U S Bureau Of Labor Statistics